The gold prices are hanging all around somewhere near to $1,000 per ounce after breaching the historical hurdle of $1,200 per oounce several months back. But soon they may break the barriers like $2,000 per ounce or $3,000 per ounce as well as $5,000 per ounce. Yes, this is true, many professionals are anticipating this to happen in the arriving months to years with this 10 years.

This kind of long term trend in the gold market is being supported by the geopolitical uncertainity, some weakness in the US Dollar, supply regulations, growing need for gold by traders and hedgers and a host of other factors! What this means is that gold market is in a long lasting bull market due to several components.

Generally during times of political and financial uncertainity, traders usually seek refuge in safe place assets such as gold. All through history, gold continues to be considered to be the ultimate investment. Right now, in modern times whenever we deal with document currencies, gold may be the ultimate currency. It is a thing that is still thought to be the ultimate store of riches. The last bull market in gold had survived for a decade. This commenced in 1970 and also resulted in 1980. This is the best time to spend money on gold as a long term trader.

However how to invest in gold? A few 5 to 10 in years past, it was not easy to invest directly in gold. Possibly you'd to purchase gold bullions or trade gold futures trading. However this modified entirely with the introduction of Exchange Traded Funds .

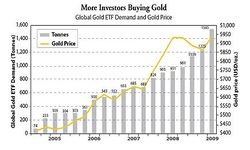

Now, Gold ETFs is probably the simplest ways to spend money on gold. These ETFs trade just like a stock. You can go long or short anytime you need. These get traded on all the major trades on the globe like New York,London, Frankfurt and others.

There is a subtle difference in numerous Gold ETFs that you need to know. Some invest straight in gold bullions and also physically possess this precious metals. These ETFs usually follow spot gold prices very correctly. However, some Gold ETFs, invest in gold futures. Under this sbi gold exchange traded fund investment, the fund managers are trying to find out locations that can mirror the price appreciation in the precious metal.

Now when you invest in these kinds of ETFs, it'll cost you a small fee as percentage in addition to a little 12-monthly expense. These types of charges aren't much as compared to investing in mutual funds. A second method to invest in these types of goods.

This kind of long term trend in the gold market is being supported by the geopolitical uncertainity, some weakness in the US Dollar, supply regulations, growing need for gold by traders and hedgers and a host of other factors! What this means is that gold market is in a long lasting bull market due to several components.

Generally during times of political and financial uncertainity, traders usually seek refuge in safe place assets such as gold. All through history, gold continues to be considered to be the ultimate investment. Right now, in modern times whenever we deal with document currencies, gold may be the ultimate currency. It is a thing that is still thought to be the ultimate store of riches. The last bull market in gold had survived for a decade. This commenced in 1970 and also resulted in 1980. This is the best time to spend money on gold as a long term trader.

However how to invest in gold? A few 5 to 10 in years past, it was not easy to invest directly in gold. Possibly you'd to purchase gold bullions or trade gold futures trading. However this modified entirely with the introduction of Exchange Traded Funds .

Now, Gold ETFs is probably the simplest ways to spend money on gold. These ETFs trade just like a stock. You can go long or short anytime you need. These get traded on all the major trades on the globe like New York,London, Frankfurt and others.

There is a subtle difference in numerous Gold ETFs that you need to know. Some invest straight in gold bullions and also physically possess this precious metals. These ETFs usually follow spot gold prices very correctly. However, some Gold ETFs, invest in gold futures. Under this sbi gold exchange traded fund investment, the fund managers are trying to find out locations that can mirror the price appreciation in the precious metal.

Now when you invest in these kinds of ETFs, it'll cost you a small fee as percentage in addition to a little 12-monthly expense. These types of charges aren't much as compared to investing in mutual funds. A second method to invest in these types of goods.